Bridge the Generation Gap

Capital Group | American Funds

July 20, 2023

Together with our partners, we provide exceptional educational content and thought leadership to our independent channel and financial institution channel clients. We are proud to offer these insights from Capital Group as published in The Edge, our quarterly growth-focused magazine for financial professionals and institutions throughout the Atria family.

Financial professionals can support family connections that lead to more successful generational wealth transfers and deeper engagement with clients. For better or worse, the coronavirus pandemic forced us to focus on our families more than ever before. That makes it a great time to reinforce family wealth planning for investors who may be interested.

As a financial professional, you are well positioned to play an important role for clients looking to do generational wealth planning. You have the ability to look beyond assets and tailor family wealth management guidance based on the needs of the individual members and the family as a whole. More importantly, you have the skills to help bridge the communication gap between today’s very distinct generations.

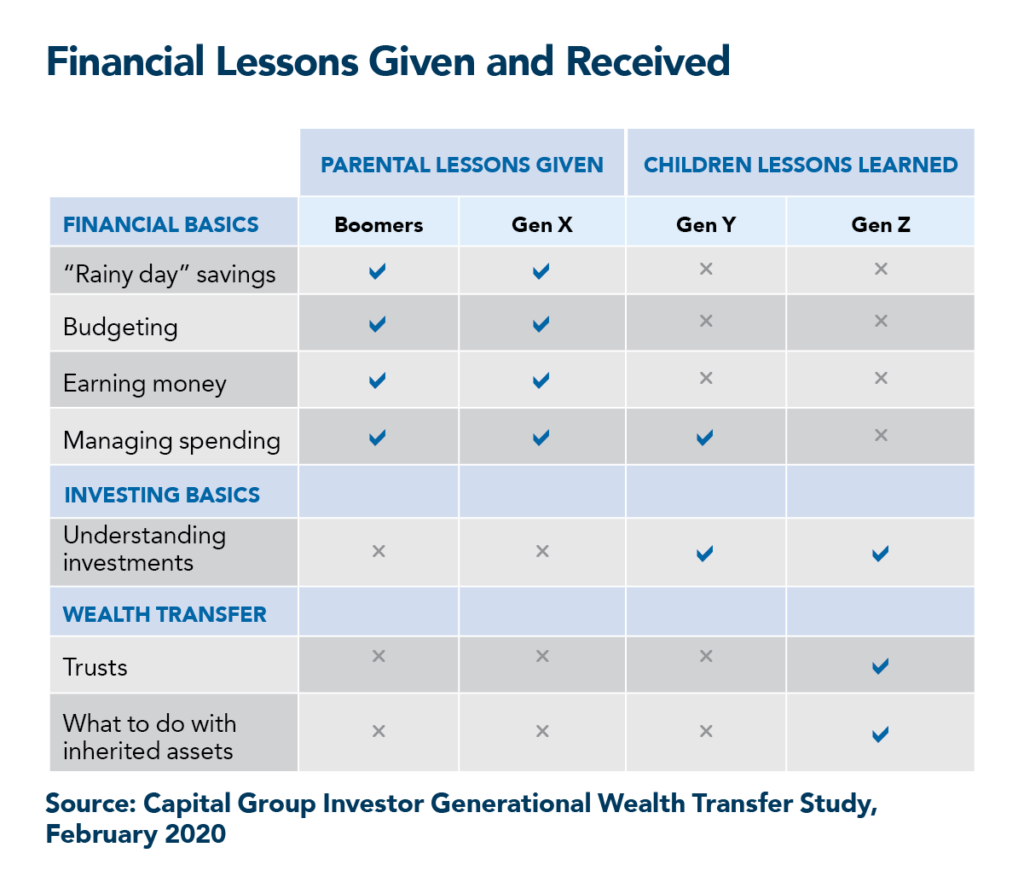

Study after study finds that more than half of wealth transfers fail,* not because of the quality of estate planning advice or structures in place, but due to inadequate preparation of the family and issues of trust and communication. Recent data from Capital Group’s February 2020 Investor Generational Wealth Transfer Study shows there remains a disconnect between the generations in terms of lessons given and learned.

The ability to bring younger generations into the financial fold increases the value of the service you provide to your clients, which can deepen your relationships and improve your advice. It could also lead to additional business. According to our study, 38% of Generation X, 62% of Gen Y and 55% of Generation Z respondents said they would work with their parents’ financial professionals, and there is perhaps no better referral than an existing relationship. With the aging generations expected to pass on $84 trillion in assets within the next 25 years,** a real need exists for generational wealth planning.

So how do you help clients bridge the generation gap? Here are four ideas for creating connections to help build and transfer generational wealth.

1. Have a family wealth briefing

If transparency is the goal, gathering everyone together for regular family meetings or “wealth briefings” can be a great way to share with the broader group. While the ultra-wealthy may favor a retreat that allows the group to learn while catching up with loved ones, a briefing can also be an in-office or virtual event that takes place in an afternoon. What matters most is individuals have the time and space needed to feel more included in the larger wealth picture — the goals for the wealth, the longterm plan, and how wealth is managed. Clarifying these objectives now can prevent future misunderstandings during wealth transitions.

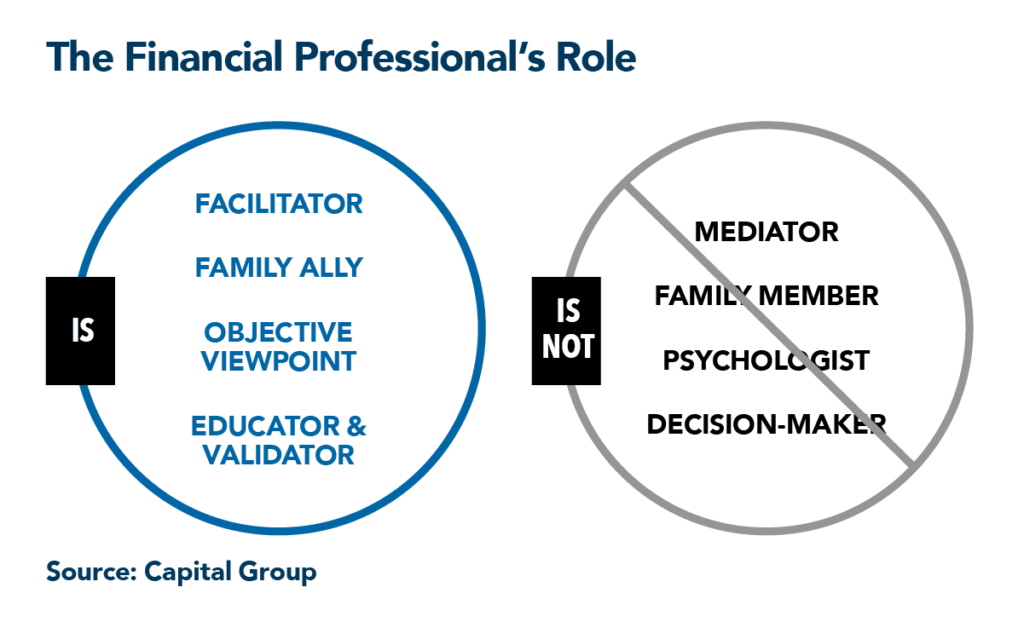

A family meeting also provides an opportunity for you to educate multiple generations on financial literacy and financial fitness, to share investment philosophy and to help echo the family’s core values. Bear in mind, however, while you serve as a family ally, you should generally not have an opinion on family matters. Your role as an advisor should be that of a neutral third party, there to facilitate so no single family member is in charge. Blurring that role can add to complications, particularly if it’s presumed you are taking sides or have some agenda in family decisions.

2. Develop family governance guardrails

As a family’s net worth increases, there may be a greater need to develop certain ground rules for the wealth. It’s control and management. This is known as family governance. The concept has long been used in family business planning, where it is crucial to have procedures and processes in place. However, families do not have to be in business together to benefit from a governance model. It offers a way to organize communication among family members, encourage problem-solving as a larger group and mutual support in decision-making.

While the way a family thinks about governance may vary, these five big-picture considerations are pretty much a constant among high-net-worth families:

- Control: Who’s in charge? Clarify everyone’s role, so it’s known who is making financial and planning decisions and who has authority.

- Process: How are decisions made and communicated? Outline exactly what to expect so there are few surprises.

- Education: Are younger generations educated about wealth, and does everyone have appropriate guidance on family finances and financial planning?

- Planning: How are we prepared for future tax and estate issues?

- Transition: Do we have everything in place to pass the reins to the next generation and beyond? You are in a good position to help answer these questions for your clients, and to help coordinate and assemble the work of trust and estate planners, accountants and lawyers. Put guardrails in place so the family can find and track this information over time.

3. Provide endowment responsibilities

For those families with the means to leave behind an endowment, charity can be an effective way of bringing family members into the wealth management process. It can provide a sense of responsibility, founded in managing assets and supporting the family mission through philanthropy. Endowments can also encourage families to make day-to-day financial decisions through budgeting and grant-making, while learning to focus on the benefits of strategic long-term investing.

Many of America’s wealthiest families (including the families of Warren Buffett, Bill Gates and the Waltons, owners of Walmart) support well-run endowments managed by family members. Charitable efforts often have an emotional appeal that can draw in different types of people, often with fresh perspectives and different points of view. Some may choose to move on to other parts of the business; others may want to remain in the nonprofit world and continue to support the family in that way.

4. Consider smaller lifetime gifts

Inter vivos gifting, gifts made while still alive, is another way to provide communication and ease the wealth transition between generations. Using inter vivos trusts, a family member can gift money or other assets during his or her lifetime. As of 2023, assets can be gifted tax-free if the value of the assets is under the gift tax minimum threshold of $17,000, per person, per year. Inter vivos trusts can provide the matriarch or patriarch of the family a peek into how certain family members might handle an inheritance.

An inter vivos gift removes the assets from the estate and probate process, and it can give the grantor a preview of what the wealth transfer process might look like. By distributing small pots of money to children and grandchildren over time, the grantor may feel more in control of the gift and more engaged with the impact it can have on other family members.

Most importantly, give younger generations access to you. Be a resource. Let them know that you’re available to answer questions or discuss investment ideas. Families that are connected to the wealth management process and demonstrate strong communication will experience an easier transition.

Continue reading about five common family leadership types and how to have a family wealth briefing in three steps at Capital Group.

* Source: The Williams Group, “Prepare Your Heirs: Why it’s so important for families to work together as a team,” 2019.

** Source: Bloomberg Wealth, “Tax-Free Inheritances Fuel America’s $73 Trillion Gilded Age,” Feb. 2022.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only. Use of this website and materials is also subject to approval by your home office.

American Funds Distributors, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.