Passing the Baton – The Art and Science of Serving NextGen Clients

Sean Meighan, Head of Advisory Services

June 30, 2023

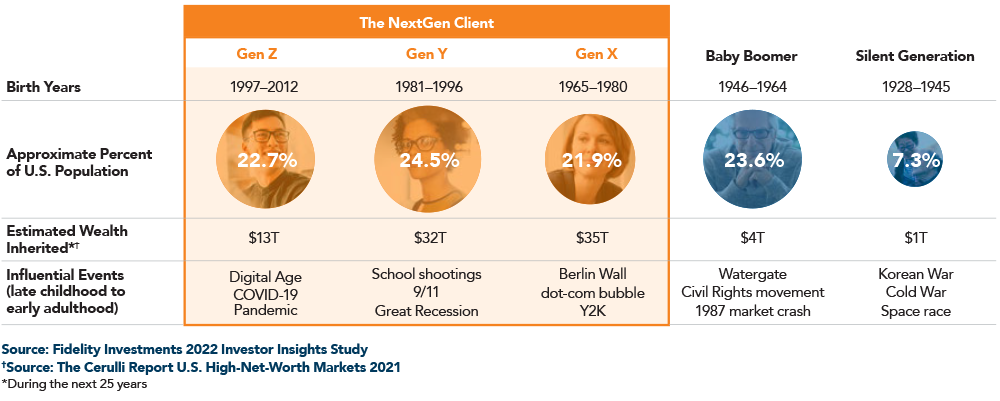

Have you ever watched the relay races during the Olympics? The most nail-biting moment of the whole spectacle is the baton pass. The slightest fumble and the leading team could drop to the last spot within fractions of a second. As financial professionals, our industry is at a similar juncture today, only with higher stakes. We’re witnessing the most significant baton pass in history — an $84 trillion wealth transfer.

I was at a neighborhood barbeque last weekend where my best friend (who also happens to be my financial professional) and I engaged in a fierce game of cornhole. While we played and watched the grill, his teenage son — who has a general idea of what we both do for a living — walked up to us with an odd question: “Why do people buy electric cars when they could just lease them and buy TSLA stock with the savings?”

As much as I was taken aback (maybe this is the new ‘buy-term-and-invest-the-rest’ mantra), I was also intrigued. So I decided to steer our small talk to finances. There I was, flipping burgers and discussing personal finance with a bunch of teens who were more used to discussing video game strategies. It was a different kind of conversation, a whole different language, but it hit me then — this is the NextGen we ought to be ready for.

Catering to the New Age clientele

Just as my wife’s obsession with avocado toast and reusable paper towels baffles me, the idea of a buttoned-up financial professional may puzzle our NextGen clients.

The wealth transfer underway isn’t just about passing on money. It’s about inheriting values, goals and dreams. And as financial professionals, we’re the trusted stewards of those dreams.

As we step into this role, we need to recognize that NextGen clients are not simply younger versions of their parents. They come with their own financial aspirations, their own values and their own set of questions — like how to support sustainable enterprises by investing in ESG. Our ability to understand and communicate with them in their language will be key to our future success.

Building trust through understanding

If there’s one thing that my weekend grilling session taught me, it’s this: NextGen clients crave understanding and deep human connection. And that understanding can only stem from real, authentic conversations, not one-off meetings to discuss quarterly returns. The beauty of these interactions is that they lead us to a shared journey with our clients, their families, their passions, their struggles and, ultimately, their financial aspirations.

Back in the day, when I was starting my career in finance and still had a full head of hair, we were primarily focused on the numbers. Today the numbers still matter, but they have become the backdrop of a broader, more exciting picture. Now, we also discuss dreams, values and legacy. And this shift, my friends, isn’t a fad. It’s a game changer, just like my over-the-counter hair regrowth treatment.

Staying ahead with NextGen tools

Just as my wife, Lisa, and I use our iPhones as parents to keep up with our kids’ whereabouts (and occasionally stalk their social media profiles), you and I — as financial professionals — need to equip ourselves with the right tools to serve the NextGen clientele. This isn’t about reinventing the wheel. It’s about adding intuitive and advanced technology to our traditional wheelhouse. At Atria, we are laser-focused on offering financial professionals the innovation and actionable steps necessary to connect with this next generation. And truth be told, the next generation isn’t a client at all — it’s an entire family tree. We believe that the future of financial advice lies not just in managing assets but in fostering human connections that span across generations. Think about the 4×100 relay. This $84 trillion wealth transfer isn’t a single baton pass but a series of multiple handoffs over the next 30 years.

To do this, we’re continually developing state-of-the-art tools and resources designed to meet the evolving needs of NextGen clients. Whether it’s offering interactive digital platforms, like Unio and Clear1, or integrating sustainable investment options into your managed account portfolios on Contour, we’re committed to staying ahead of the curve and providing solutions that empower the financial future of the next generation.

Life advice

Just like I learned to appreciate avocado toast and reuse paper towels for the sake of my marriage, we also need to adapt and evolve to serve our NextGen clients effectively. The successful financial professional of tomorrow won’t just manage wealth; they’ll serve as the guiding light that navigates families through generations of financial decisions and deeply personal life events. They’ll understand the different languages of multiple generations and bridge the gap between traditional financial practices and future financial aspirations.

As I look forward to the future of our industry, I’m inspired by the stories of clients like my friend’s teenage son, who, despite his fascination with gaming and a seemingly unshakable belief that vegetables are a myth, is beginning to grasp the importance of financial planning. Conversations with NextGen clients like him remind me why we do what we do each day — empower individuals to make informed financial decisions and create a legacy that will positively impact future generations. In the end, serving the NextGen client is about more than just the successful transition of $84 trillion. It’s also about guiding the next generation as they wield this financial power and helping them achieve their dreams while fulfilling their responsibilities.

This, my friends, is the new marathon we are running. It’s not just about the baton pass anymore; it’s about coaching the next runner, ensuring they are ready for the long, thrilling sprint ahead. Let’s lace up our shoes, step onto the track and prepare for the relay race of a lifetime. After all, the future of financial advice is not just a handover; it’s a hand-in-hand journey into the future of wealth management.

Generations at a Glance

For help navigating this wealth transfer and reaching the next generation investor, reach out to marketing@atriawealth.com.